Council rates are a form of property tax that help fund various local services and infrastructure, such as rubbish collection, road maintenance, parks, libraries, and community programs.

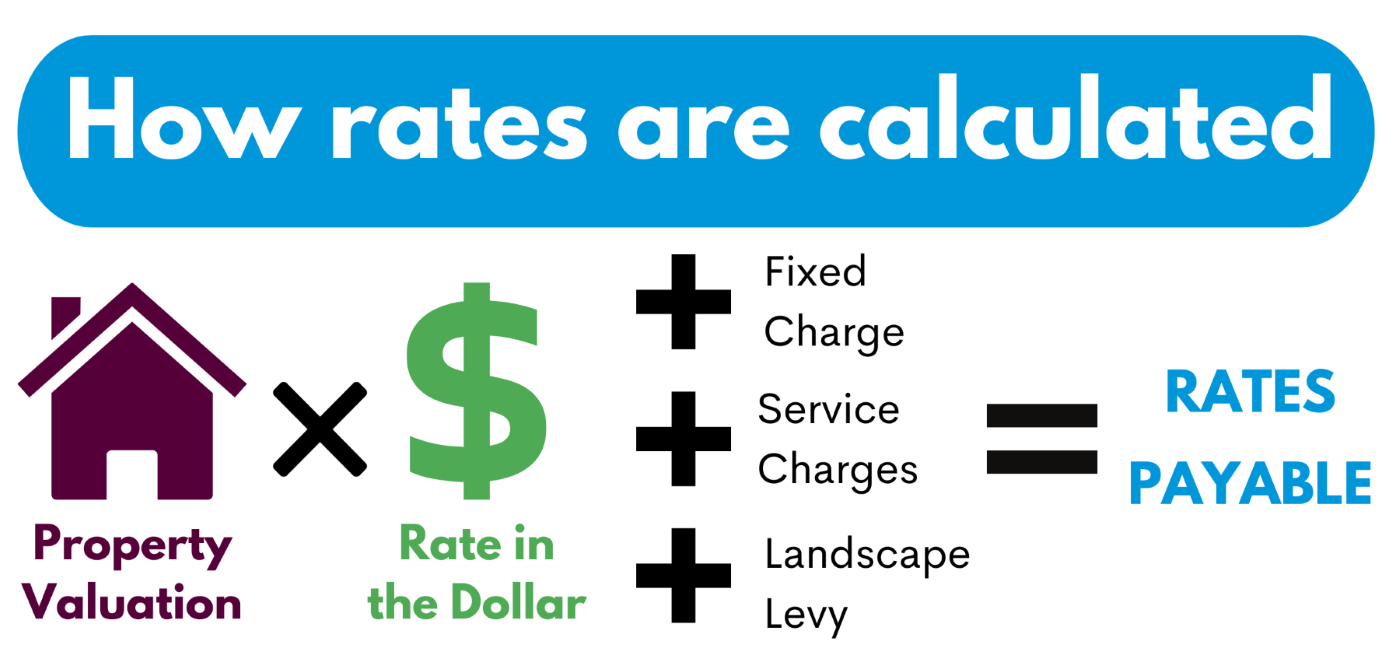

The rates you see on your rates notices are made up of the following calculations:

- valuation of your property

- local government category such as primary production, residential, etc

- the rate in the dollar applied to your valuation

- any fixed charge

- service rates and charges including waste services

- levies Council is required to collect for state government such as Regional Landscape Levy